Andreas Rentz

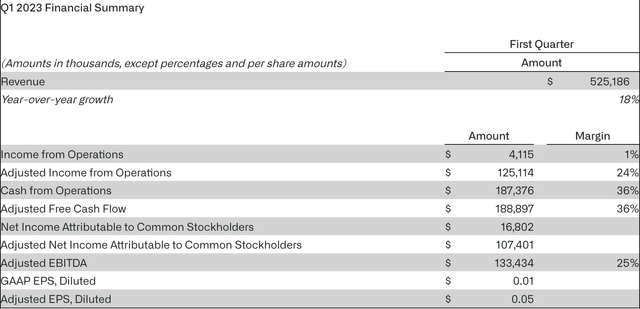

Palantir Technologies Inc. (NYSE:PLTR) just released its fiscal first quarter earnings. The release beat analyst estimates on revenue as well as on earnings per share ("EPS"). Particularly noteworthy in the release was stock-based compensation ("SBC"), which declined compared to the fourth quarter amount ($129 million).

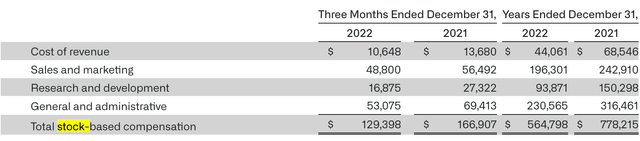

Stock-based compensation has long been a sticking point for Palantir shareholders. The company has been free cash flow ("FCF") positive for over a year now, but adjusting FCF for SBC has tended to yield a less rosy picture. This is why, in most quarters since it went public, Palantir's GAAP earnings have tended to be negative.

This quarter was far ahead of estimates on just about every metric that counts. The amount of SBC was just $114 million, which was down considerably from previous years. In fiscal 2022, PLTR had over $778 million in SBC costs; at the current pace, it would have only $456 million in such costs in this fiscal year, so the SBC picture has gotten much better.

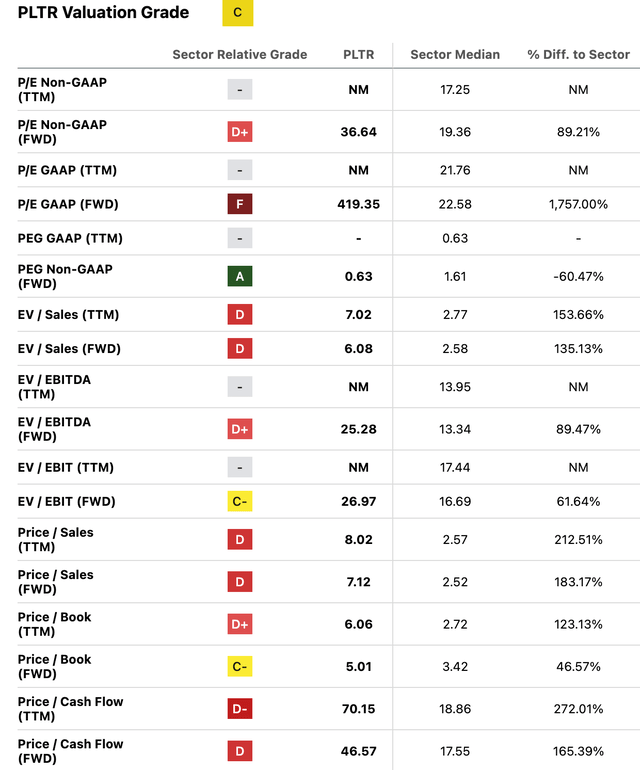

However, Palantir's valuation remains outrageously high. According to Seeking Alpha Quant, the stock trades at 36 times forward adjusted earnings, 419 times 2023 GAAP earnings, seven times sales, six times book value, and 70 times operating cash flow. That certainly isn't cheap. In fact, it's significantly more expensive than the average NASDAQ 100 (NDX) stock, which trades at 23.7 times earnings.

For this reason, I can only rate Palantir stock a "hold." Yes, the trends in the business are mostly positive ones, but they aren't so positive that they'll cause the stock to catch up with its valuation in record time. 18% growth is certainly good, but at 70 times operating cash flow, it might not be enough. Palantir is growing fast enough that I wouldn't expect severe losses for those buying now. But I don't think it's going to deliver red-hot returns if present trends continue.

Earnings Re-Cap

Palantir's first quarter release beat estimates on every single metric worth noting, boasting metrics like:

-

$17 million in net income, up from a loss (a beat).

-

$0.01 in EPS, up from a loss (a beat).

-

$0.05 in adjusted EPS (a beat).

-

$525 million in revenue, up 18% (a beat).

-

$236 million in commercial revenue, up 15%.

-

$289 million in government revenue, up 20%.

-

$114 million in SBC, down $15 million from Q4.

Palantir Q1 earnings (Palantir)

Overall, Palantir's earnings beat expectations, and it rallied 17% after-hours, as I noted in a Tweet shortly after the earnings came out.

On the whole, I would say that a committed Palantir bull ought to be happy with these results. As a value investor, I just can't come to terms with the multiples this company trades at (more detail on that in a later section), but if you've always liked Palantir, then you ought to like it more after these results. Q1 was Palantir's most GAAP profitable quarter ever, beating Q4 by $6 million. The growth also did not slow down from Q4, staying unchanged at 18%. There was a lot to like in this release-though PLTR stock remains expensive.

Palantir's SBC Trend

Since the latter quarters of 2022, we have seen marked improvements in the amounts of SBC that Palantir has been handing over to employees. Here's some data to illustrate that:

-

Total SBC, 2021: $778 million.

-

Total SBC, 2022: $548 million.

-

Fourth quarter: $129 million.

-

First quarter: $114 million.

Palantir SBC (Palantir)

At this pace, we would expect SBC expense to continue coming down year after year. However, the pace at which it is slowing down is not that rapid. In 2022, PLTR booked $564 million in SBC costs. In the fourth quarter, it booked $129 million, which works out to $516 million on an annualized basis. In the first, it booked $114 million, which works out to $456 million on an annualized basis.

The picture has certainly improved, but for a company doing around $500 million in quarterly revenue, $100 or more in SBC is going to put a lot of pressure on margins. So, investors will want to see these SBC figures decline further; the amount of SBC is enough to significantly eat into whatever "free cash flow" Palantir generates on paper.

Competitive Position

Now, we can get to a much more positive part of the analysis:

Palantir's competitive position.

In this author's opinion, Palantir does not have a single "true" competitor, in the sense of another company doing the exact same thing for the exact same clientele. There are companies that make data platforms similar to Palantir's, but they generally don't sell them to the Department of Defense ("DoD") or Central Intelligence Agency ("CIA"), so Palantir has its main clients largely locked down.

Some companies that have been claimed as "Palantir competitors" include:

-

Alteryx (AYX) - a company that competes with Palantir in data preparation.

-

Cognizant (CTSH) - a company that competes with Palantir in data engineering and AI.

-

Splunk (SPLK) - a company that helps its clients take in and visualize data. However, SPLK focuses on machine-generated data, whereas Palantir is more diverse in the data sources it can take in.

-

Tableau - a data visualization company. Business Strategy Hub says that it is more advanced at visualization than Palantir is, although it does not do all of the things that Palantir does.

As you can see, there are many companies that do things similar to what Palantir does. However, all of the companies above only compete with Palantir on one or two key features; Tableau only competes on visualization, for example. For this reason, they are unlikely to ever eat into Palantir's moat in providing big data services to defense and intelligence agencies; they just don't offer the full package of services. If the DoD did join one of the services listed above, it would be as an adjunct to Palantir, not as a substitute.

Valuation

Now we get to the most bearish part of the analysis for Palantir, and the reason I'm not personally going to buy the stock even though I found the first quarter results impressive: valuation. I already summarized Palantir's multiples at the beginning of this article; for a quick recap, check out the image below:

PLTR multiples (Seeking Alpha Quant)

As you can see, Palantir scores a "C" in Seeking Alpha's quant system for multiples. Not great, but not the worst in the tech world, either.

We could also look at PLTR's valuation from the perspective of discounted cash flows. In building an FCF model for PLTR, I'll use EPS in place of free cash flow, because EPS incorporates the effect of SBC.

For this model, I'll assume:

-

Revenue grows at 15% CAGR over the next five years.

-

COGS also grows at 15% CAGR.

-

Operating expenses grow at 10% CAGR.

-

Net interest stays unchanged at $16.3 million (benefit, not expense).

-

The effective tax rate rises to 15%, reflecting the renewed profitability.

-

Shares outstanding averages 2.3 billion over the period (higher than the current share count, but implying lower future growth in shares).

With these assumptions, we get the following model:

|

Base Year |

Year 1 (TTM) |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Rev |

$1.985B |

$2.283B |

$2.625B |

$3.018B |

$3.47B |

$3.99B |

|

COGS |

$421.7M |

$484.95M |

$557.69M |

$641.3M |

$738M |

$848M |

|

Operating expense |

$1.68B |

$1.85B |

$2.03B |

$2.23B |

$2.46B |

$2.7B |

|

Interest |

$16.3 million |

$16.3 million |

$16.3 million |

$16.3 million |

$16.3 million |

$16.3 million |

|

Tax |

7.18M |

0 |

$12.09M |

24.45M |

$43.24 |

$68.745M |

|

Net income |

$-107M |

$-35.8M |

$68.89 |

$138.55M |

$245M |

$389.995 |

|

Shares outstanding |

2.2B |

2.32B |

2.32B |

2.32B |

2.32B |

2.32B |

|

EPS |

($-0.049) |

($-0.015) |

$0.029 |

$0.059 |

$0.105 |

$0.167 |

The first year's cash flow is near zero, so we'll count it as $0. The present values of the remaining EPS figures, discounted at 5%, sum to $0.29, which is not enough to justify PLTR's stock price. However, there's still the matter of terminal value. Since Palantir is a very young company with a strong competitive position, I'll assume it can keep growing perpetually at 4%. This would leave us with a year six "cash flow" of $0.172, which would be worth $17.2 in year six. Discounting this back to the present leaves us with $13 in terminal value using a 5% discount rate and a 4% growth rate. So we get $13.29 in fair value. This implies some upside, though keep in mind that some would use a higher discount rate than I've used in a model that actively assumes positive growth.

The Big Risk to Watch Out For

While my Palantir model leaves PLTR stock with considerable upside, there is one major risk to the scenario this model depicts:

Greater than expected SBC.

I've assumed here that the average Palantir Technologies Inc. share count over the next six years is 2.3 billion, or 2.2 billion now plus 2.32 billion on average over the following five. If the share count grows faster than this, then my model will end up being way off the mark. It's for this reason that I rate Palantir stock a hold rather than a buy. We still need to see Palantir Technologies Inc.'s stock-based compensation to come down even further for the stock to have an upside. If it keeps growing at the present rate, then the model I constructed will not be accurate.

On the whole, Palantir Technologies Inc. stock is a classic hold: no harm to investors who bought cheaper, but not the most attractive place to deploy capital in today.

Article From & Read More ( Palantir Earnings: SBC Slowdown And Real GAAP Profits (NYSE:PLTR) - Seeking Alpha )https://ift.tt/FD3AUg1

Business

Bagikan Berita Ini

0 Response to "Palantir Earnings: SBC Slowdown And Real GAAP Profits (NYSE:PLTR) - Seeking Alpha"

Post a Comment