Venugopal Dhoot, one of India's best-known business tycoons, was arrested earlier this week - nearly four years after India's federal investigation agency filed a case of criminal conspiracy and fraud against him.

His detention came on the heels of the arrest of former ICICI Bank chief Chanda Kochhar and her husband Deepak for an alleged fraud where it is claimed that Kochhar sanctioned high-value loans to Dhoot's company in 2009 in exchange for investment in her husband's renewables business.

ICICI is India's third-largest lender and Kochhar, an iconic CEO, was seen as a poster woman for the banking industry.

Kochhar and her husband have denied allegations of quid pro quo, saying the investment from Dhoot's company was a genuine one.

These arrests mark a crucial turning point in a case that has seen its first arrests since the alleged offences were recorded by investigators in January 2019.

According to local media reports, Dhoot, who has been denying the allegations, has offered to turn approver (give evidence).

"This could open a Pandora's box," Arvind Gupta, an ICICI shareholder who blew the whistle on the alleged scam in 2016, told the BBC.

"The investigation is a start in the right direction, but its scope needs to be widened since Kochhar wasn't the only person on the ICICI credit committee that approved the loan," Mr Gupta said.

He added that the complexity of the alleged fraud would require inter-departmental coordination between all of India's investigative agencies to get to the bottom of the case.

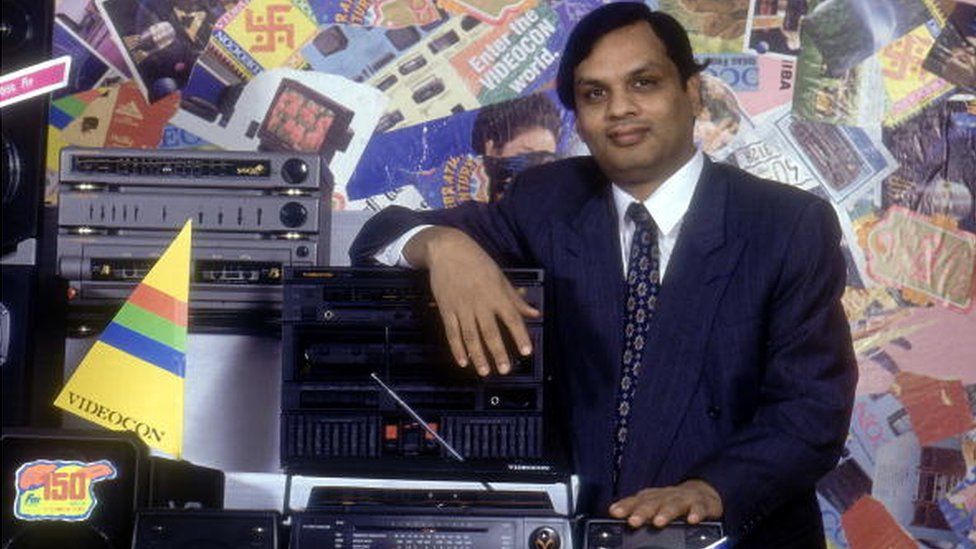

The rise of Venugopal Dhoot

Through the 1990s and the early years of the new millennium, Venugopal Dhoot was a ubiquitous presence at industry events, corporate soirees and budget consultations.

He was a darling of business journalists because of his accessibility and willingness to give a quick byte or quote, and his views were much sought after.

Born in an agrarian family that had the licence to distribute Bajaj scooters in Aurangabad city and other parts of the western state of Maharashtra, Dhoot was instrumental in Videocon's spectacular transformation into a consumer goods firm by the 1990s.

The company was among the first to introduce colour television sets in India and gradually expanded into manufacturing other consumer appliances such as washing machines, air conditioners and refrigerators, earning Dhoot the moniker "king" of India's white goods market.

Dhoot came from a small town and struggled with speaking English initially but that didn't come in the way of his building good relationships with politicians and other businessmen.

Until the 1990s, he reaped the benefits of sky-high import duties on global firms, which made it hard for those brands to compete with Videocon, according to Arvind Singhal, chairman of retail consultancy Technopak Advisors.

But an aggressive branding and distribution strategy was also a key reason why it outlasted other homegrown brands in the market for nearly two decades.

"They roped in cricketers and film stars and invested in a pan-India network of distribution and service stores," Mr Singhal says. "They were number one in the market, and then a respectable number two and number three right until 2008-09."

The downfall

It was the combination of intense competition from South Korean brands such as Samsung and LG, and Videocon's unnecessary diversification into "fantasies" such as oil and gas and telecom at a time when they should've been protecting their core turf, that precipitated Dhoot's downfall, Mr Singhal says.

After winning spectrum to launch commercial operations, Videocon Telecommunications was among the companies that saw their licences being cancelled following the 2G spectrum scam - relating to alleged irregularities in the selling of telecom spectrum licences.

It won the licence back in some states, but eventually wound down operations after selling the spectrum to Bharti Airtel.

Dhoot's ambition of metamorphosing into an oil and gas giant didn't materialise either. His insurance business met a similar fate.

By 2012, Videocon was one among a list of other highly indebted firms - including the Essar Group, GVK, GMR, and Reliance ADAG - that Credit Suisse's House of Debt report said posed a "concentration risk" to Indian banks.

The aggregate debt of these 10 groups was equal to 13% of bank loans and 98% of the banking system's net worth.

A review of the situation three years later by Credit Suisse found that that despite attempts by groups like Videocon and GMR to reduce debt through asset sales, their financial stress had "intensified further", with Dhoot's company seeing among the largest increase in debt levels.

By 2018, India's bankruptcy court had initiated insolvency proceedings against Videocon. In under a year, Dhoot was also battling federal investigations into the ICICI Bank loan, for which he is in custody.

The endgame

As a probe begins into the alleged wrongdoings, ICICI Bank remains a resilient force, and barring Kochhar, seems to have put the crisis behind itself and moved on.

But for Dhoot, a comeback to the pole position he once commanded will be a tall order.

His meteoric success, and dramatic downfall, are in many ways no different from a number of other Indian industrialists who through the 2000s diversified through borrowings, says Amit Tandon, founder and managing director of IiAS, an institutional advisory.

"Diffused focus and macro-economic headwinds hit many who either lost their business or are a pale shadow of themselves."

Read more India stories from the BBC:

https://ift.tt/k14NXaY

Business

Bagikan Berita Ini

0 Response to "Venugopal Dhoot: How a 'loan scam' led to Videocon owner's downfall - BBC"

Post a Comment